[ad_1]

Some SMEs don’t wish to get (or have entry to) fairness funding, but additionally wish to keep away from high-interest financial institution loans. That’s the hole that revenue-based financing platforms like GetVantage wish to fill. The Mumbai-based startup introduced at this time that it has raised $36 million in fairness and debt led by Varanium Nexgen Fintech Fund, DMI Sparkle Fund, together with returning traders Chiratae Ventures and Dream Incubator Japan. Varanium Capital companion Aparajit Bhandarkar will be a part of GetVantage’s board.

Different individuals included Sony Innovation Fund, InCred Capital and Haldiram’s Household Workplace. This brings GetVantage’s complete raised thus far to $40 million, together with a seed spherical in 2020, the identical yr it was launched by Bhavik Vasa and Amit Srivastava. GetVantage says this consists of a number of debt strains with non-banking monetary corporations to assist scale its financing platform.

Vasa informed Nob6 he co-founded GetVantage after working as chief development officer at fintech Itzcash. “I got here throughout the ‘advert for fairness mannequin,’ a barter deal the place media homes take a sure stake in corporations in return for promoting and promotions on their platform.” He then moved onto a job at remittance platform EbixCash and after quitting, he stated he stored considering of a approach to offer various financing to startups.

“The standard means of elevating capital is complicated, cumbersome and easily doesn’t work for all enterprises and enterprise house owners,” Vasa stated. Many on-line entrepreneurs are underserved, he added, as a result of “the VC mannequin is considerably damaged and actually based mostly on who you understand.” For founders with out the fitting community, it’s onerous to seek out traders. Some additionally favor to not promote management and dilute possession of their corporations.

Vasa stated he and Srivastava’s background as founders give them a bonus, as a result of they perceive the wants of different founders. The 2 met whereas working the Startupbootcamp fintech cohort.

GetVantage provides SMEs equity-free capital between $10,000 to $500,000 USD, with purposes processed in about two days, and funds made accessible in 5. It says that about 4,000 companies have utilized for non-dilutive financing by its platform thus far, receiving a complete of $270 million in funding. A few of its shoppers embrace Arata, BoldCare, Eat Higher, Jade Forest, Naagin, Nua Wellness, Rage Espresso, Sid Farms and Zymrat.

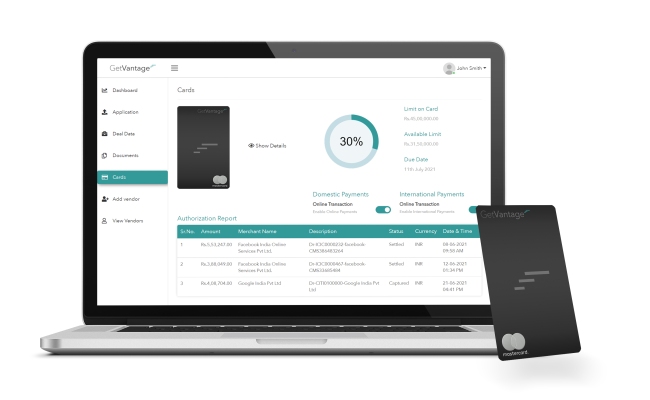

Financing choices are made utilizing the corporate’s algorithms, which it says helps do away with bias and make the appliance course of sooner. Its core tech is a proprietary machine-based studying mannequin known as the Credit score Choice Engine and cloud-based Deal Administration System.

Firms making use of for capital join their digital advertising and marketing platforms, like Google or Fb, and income accounts together with Shopify, Amazon, RazorPay or Stripe, to GetVantage’s platform. By doing that, they share their enterprise’ spending and income for the previous 12 months. GetVantage’s Credit score Choice Engine then generates a personalized time period sheet in about 48 hours. After getting funds, shoppers then repay a pre-determined share of their income till they’ve paid again the complete principal.

Vasa stated corporations usually repay financing in about six to 9 months. There isn’t any curiosity, and the corporate prices flat charges between 6% to 12%. “What’s essential to know is that repayments are versatile and utterly linked to income,” Vasa stated. “So if income goes up, an organization finally ends up paying again slightly extra in a selected month. If income goes down for some cause, the corporate pays again rather less that month.”

GetVantage is sector- and size-agnostic, focusing on corporations with sturdy fundamentals, recurring revenues and a revenue-vintage of between six to 12 months. Its shoppers have come from sectors as various as SaaS, direct-to-consumer e-commerce, edtech, well being tech, cloud kitchens and diet. The corporate claims that it noticed 300% year-over-year development in 2021, and helped its shoppers obtain 1.8x income development after receiving funding by GetVantage.

For entrepreneurs, GetVantage additionally has partnerships with quite a lot of companies, together with in advertising and marketing, gross sales, logistics and cost gateways. For instance, distributors on some e-commerce marketplaces can apply for GetVantage funding immediately by them, or by varied cost gateways, advertising and marketing and logistics platforms.

Within the long-term, GetVantage has its eye on Southeast Asia and the Center East as potential markets, however for the time-being, it’s “laser-focused” on India, Vasa stated, citing statistics that say the market alternative for revenue-based financing is now $5 billion to $8 billion and anticipated to develop to $40 billion to $50 billion because the direct-to-consumer market expands to $100 billion by 2025.

In a ready assertion, Bhandarkar stated, “At Varanium we glance to companion with founders and groups which have a daring strategy to fixing large issues. We’re thrilled to help Bhavik and the GetVantage administration group to assist speed up GetVantage’s subsequent section of development and unlock capital and revenues for 1000’s of fast-growing companies that may energy the way forward for India’s digital financial system.”

[ad_2]

Source link