[ad_1]

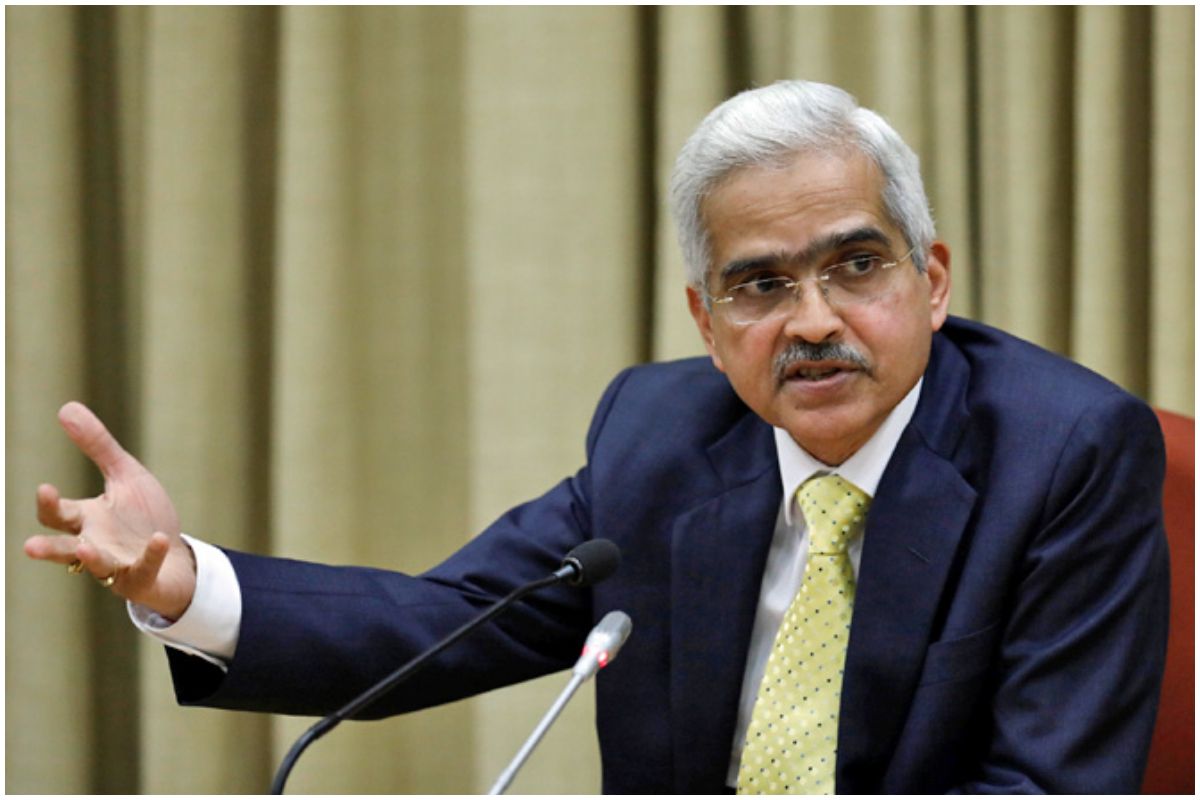

New Delhi: The inflation price in India is more likely to keep inflated within the close to time period. Based on the most recent assertion by Governor Shaktikanta Das, it’s more likely to stay above the RBI’s higher tolerance restrict of 6 per cent by December 2022. Based on a report by Reuters, Das mentioned that India is effectively on monitor to bringing down inflation.Additionally Learn – Financial institution of India Revises Curiosity Charges on Mounted Deposits For Numerous Tenures: Verify New Charges Right here

He was quoted as saying, “We’re effectively on monitor to carry down inflation and inflation expectations. Till December, CPI is anticipated to stay greater than the higher tolerance stage. Thereafter, it’s anticipated to go beneath 6% as per our present projections.” Additionally Learn – RBI Extends Deadline to Implement New Tips For Credit score Playing cards to October 1 | Particulars Right here

Inflation in India hit an eight-year excessive mark in April at 7.79 per cent. It eased just a little in Might however nonetheless remained exterior the RBI’s tolerance band of 2-6 per cent. Based on specialists, the excessive costs are resulting from supply-side constraints, majorly on the again of the continued Russia-Ukraine conflict. Additionally Learn – New Debit Card, Credit score Card Tokenisation Guidelines To Change From July 1 | All You Have to Know

The RBI decides the financial coverage which helps in regulating the liquidity and the demand within the financial system. It has been navigating by way of troubled waters to manage inflation. But, Das is optimistic on the impression of the financial coverage.

He mentioned, “Inflation expectations affect not solely households but additionally companies and drive up pricing of meals, manufactured items and providers. In the event that they anticipate inflation to be excessive, even firms will defer their funding plans.”

Page Contents

Rupee all-time low

On Wednesday, the Indian rupee hit an all-time low of 78.39 towards the USD. Das mentioned that it’s majorly because of the tightening of financial insurance policies by superior economies. The Fed has been hawkish on the rates of interest because the US continues to reel below a 40-year excessive inflation price.

He added, “In such a state of affairs, there will likely be outflow of capital from rising market economies. It’s taking place throughout rising market economies. That is nothing however the spillover of the financial coverage actions in superior economies.”

$(document).ready(function(){ $('#commentbtn').on("click",function(){ (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "//connect.facebook.net/en_US/all.js#xfbml=1&appId=178196885542208"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

$(".cmntbox").toggle();

});

});

[ad_2]

Source link