[ad_1]

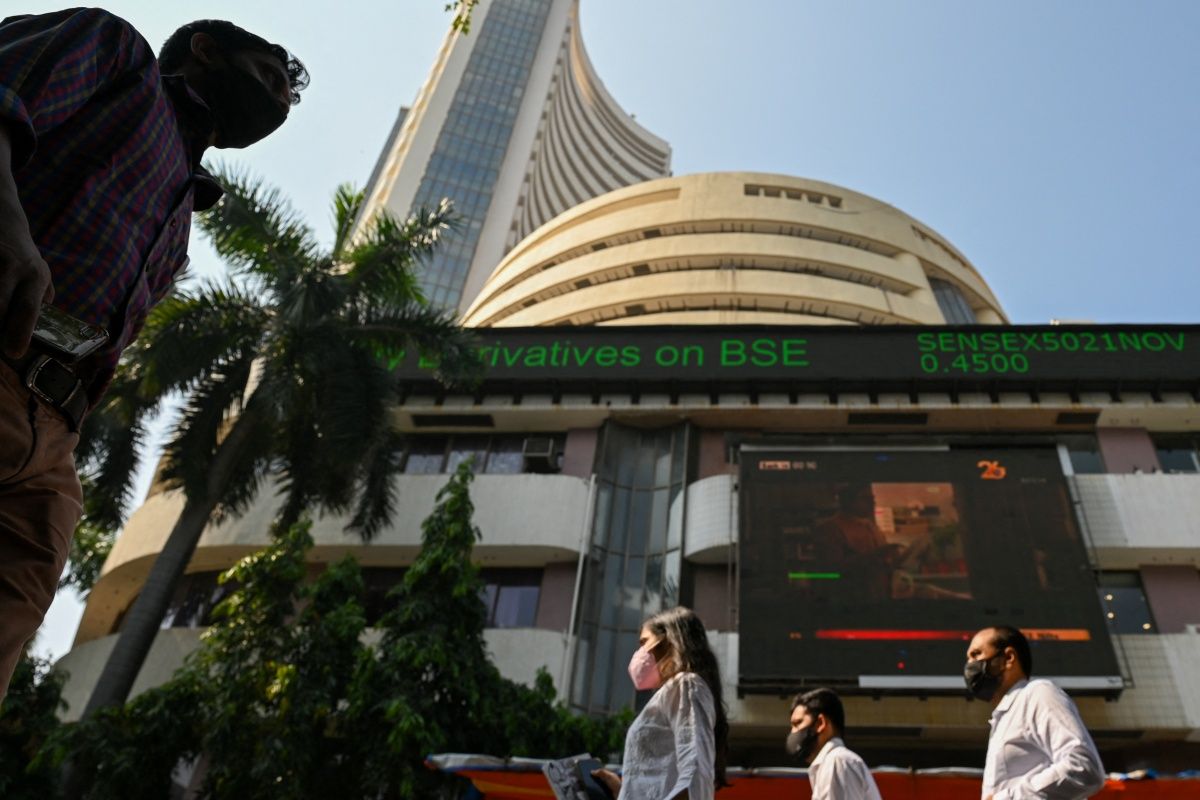

Share Market Information | New Delhi: Final week noticed a serious correction within the Indian share market. The followers of share market information should be properly conscious that out of 5 periods, benchmark indices declined 4 instances in a single week. The RBI’s financial coverage announcement on Wednesday was an added issue. Fitch Rankings, whereas reducing the GDP progress projection, revised the nation’s outlook from unfavourable to steady.Additionally Learn – Rupee Breaches 78-Mark In opposition to USD For First Time Ever

Nifty50, the benchmark index of the NSE, fell over 2.3 per cent final week. The autumn was primarily led by the exit of overseas traders from the markets. Nevertheless, allow us to take a look at 5 triggers that will dictate the share market within the upcoming week. Additionally Learn – World Promote-Off, Excessive Inflation: Sensex Sheds 1,400 Factors, Nifty Close to 15,800

Page Contents

5 Triggers for share market this week

- India’s Inflation Knowledge: The info associated to India’s inflation will almost definitely be introduced on Monday. Amidst excessive international inflation, evident from US inflation knowledge revealed on Friday, India’s numbers are additionally anticipated to remain elevated. Final month, the retail inflation was recorded at 8.7 per cent.

- Covid-19 fourth wave: The nation has seen a serious uptick within the recorded circumstances of what’s being known as the fourth wave of Covid-19. As of Friday, India’s whole tally stood at 36,267. If the circumstances carry on rising on the present tempo, the exit of FIIs from Dalal Avenue might flip even sooner.

- Fed Fee Announcement: After revealing the inflation figures final week, the Federal Reserve will announce the rate of interest change within the upcoming week. In line with consultants, the financial institution might hike rates of interest by 50 foundation factors. It will act as a serious set off for Indian in addition to overseas traders.

- Rupee vs Greenback: Rupee has carried out particularly weak within the final week. For 2 steady days, the forex touched an all-time low in opposition to the Greenback. If the rates of interest are hiked by the Fed, the Indian rupee might weaken additional, leaving the overseas merchants in addition to traders in a repair.

- World manufacturing knowledge: Industrial manufacturing is without doubt one of the largest indicators of the economic system. This week, Europe, in addition to China, will announce their industrial manufacturing knowledge. If the quantity is disappointing, debates round international financial slowdown might resurface.

Additionally Learn – Who Is R Subramaniakumar, RBL Financial institution’s new MD & CEO

$(document).ready(function(){ $('#commentbtn').on("click",function(){ (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "//connect.facebook.net/en_US/all.js#xfbml=1&appId=178196885542208"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

$(".cmntbox").toggle();

});

});

[ad_2]

Source link