[ad_1]

Based mostly in Vietnam, Anfin desires to show extra folks into inventory buyers with options like fractional buying and selling and in-app communities. The Y Combinator alum introduced immediately it has raised a $4.8 million Collection A led by angel investor Clement Benoit, the founding father of Stuart and Not So Darkish, and Y Combinator. Contributors within the spherical additionally included Insurgent VC, Kharis Capital, Newman Capital, First Test Ventures, Micro Ventures, Springcamp and AngelHub.

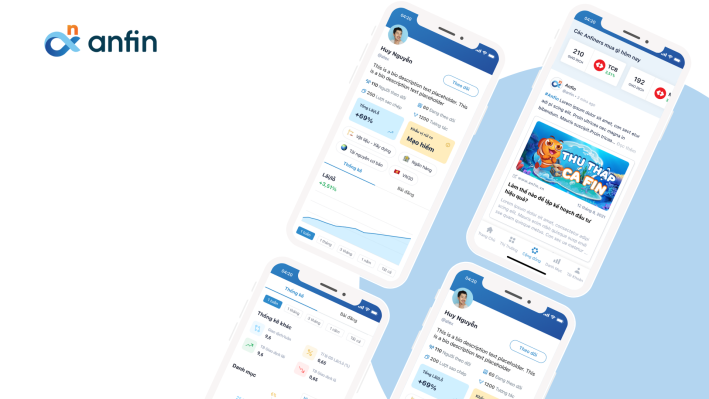

The funding shall be used on Anfin’s product improvement, particularly its social funding options, together with one which lets customers host and be part of dwell audio rooms. The app’s proprietary inventory buying and selling platform consists of inventory profiling and threat evaluation. It additionally plans to supply extra monetary asset courses, along with its present 300 shares and 9 ETFs.

Its fractional buying and selling options lets customers beginning investing with as little as 10,000 VND (or about 40 U.S. cents), giving them entry to shares they may in any other case not be capable of afford. Like different funding apps aimed toward Gen Z and millennial customers (90% of Anfin’s customers are 18 to 35 years outdated), Anfin has academic content material about inventory market fundamentals.

Anfin founders Hiep Nguyen, Phuoc Tran, Chi Pham and Michael Do

Anfin was launched in October 2021 by Hiep Nguyen, Phuoc Tran, Chi Pham and Michael Do. Its founders say it has been downloaded greater than one million occasions since then, pushed partly by elevated curiosity in cellular banking and on-line investments throughout the COVID-19 pandemic. It now has 100,000 funded accounts and deposits have reached as much as $5 million and $10 million in complete transaction worth.

The startup is the newest funding app in Southeast Asia to get enterprise capital funding. Different examples embrace Pintu, Pluang, Bibit, Ajaib and Syfe.

Do advised Nob6 that Anfin’s founders acquired inquisitive about a inventory buying and selling app “by observing the disconnect from the rising demand of shares as an asset class with the rising price of investing within the inventory market. Particularly, Vietnam modified its buying and selling lot dimension from 10 shares to 100 shares, which meant blue chip shares price $400 to $600 for one full lot.”

Consequently, Anfin’s founders noticed a possibility to decrease the price of investing by providing fractional shares and changing into a liquidity supplier, or charging a ramification for fast settlement. Do added that fractional buying and selling is Anfin’s hottest options, with common transaction values of $20.

One think about Anfin’s favor is the Vietnamese government’s goal of increasing the amount of people who put money into shares from 3% in 2021 to five% in 2025, and 10% in 2030.

Anfin’s social funding product permits customers to speak with each other. It additionally features a newsfeed rating algorithm and using a “bull and bear”-like system that identifies and options high merchants on the app, Do mentioned.

“Constructing this characteristic immediately within the app reinforces belief because the funding profile options metrics that spotlight an investor’s monitor document and threat stage,” Do mentioned. Ultimately, the app can even embrace influencer-driven incentives (Do mentioned the staff prefers the time period social investing over copy buying and selling).

Anfin monetizes by buying and selling commissions. Do mentioned the app doesn’t consider in cost for order stream (PFOF) or promoting its person knowledge. As a substitute, it integrates immediately with brokerage companions and order for its customers by Vietnam’s regulated exchanges. It additionally has a subscription characteristic referred to as Anfin VIP that provides the startup a supply of recurring income.

In a ready assertion, Benoit mentioned, “Democratizing entry to inventory buying and selling with a social layer by a easy and pleasant product is unquestionably the reply to a big untapped market in Asia. I’ve little question that this Collection A funding will permit Anfin to scale past Vietnam and change into a reference in social buying and selling.”

[ad_2]

Source link