[ad_1]

Information tales over the previous two years spotlighted the issues hospitals and different medical organizations have been having in procuring masks, gloves and different important medical provides as hospital items grew crowded with COVID sufferers.

Bttn co-founders JT Garwood and Jack Miller heard the decision and began the Seattle-based firm in March 2021 after seeing the challenges medical organizations confronted in not solely discovering provides, however truthful costs for them.

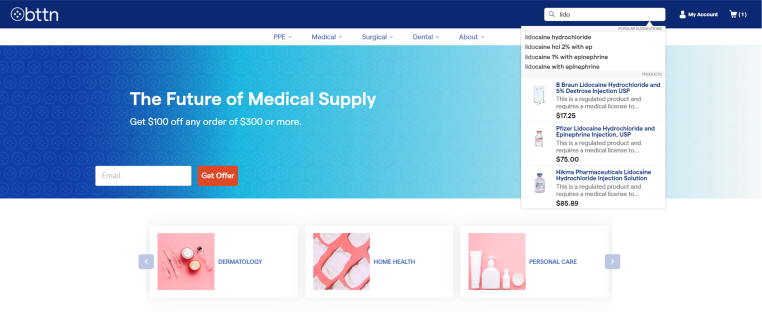

The corporate’s business-to-business e-commerce market offers a wide range of name-brand medical provides, saving its clients a median of between 20% and 40%, whereas offering a greater ordering and transport expertise.

“From a provide chain perspective, the pandemic was the height of terribleness,” Garwood instructed Nob6. “There have been a number of backorders and big producers have been out of manufacturing. We felt it was a possibility to step up throughout a time of depth to assist observe house owners save money and time and get entry to merchandise they couldn’t by way of their conventional channels.”

JT Garwood, co-founder and CEO of bttn. Picture Credit: bttn

That work has paid off, he added, and clients are “coming again in droves.” Bttn’s market now has greater than 2.5 million merchandise and continues to “rip-and-replace” the best way healthcare distribution is managed.

The corporate, going after a U.S. wholesale medical supply market poised to be valued at $307 billion this yr, has skilled hypergrowth since we profiled bttn’s $5 million seed spherical in August 2021. At the moment, the corporate was working with 300 clients, together with particular person practices, surgical facilities and over 17 healthcare associations throughout the nation.

In the present day that quantity has jumped to 7,000 clients, together with greater than 500 healthcare practices that bought provides by way of bttn for the primary time in April, Garwood stated. Throughout that month, the corporate added eight distribution and success facilities. Between August and Might, bttn additionally boosted its worker headcount to 75 (from 10) and grew its gross merchandise quantity 1,000%. In Might, the corporate reached a milestone of over 1,000 orders.

With all of that demand and exercise, bttn is again with a bigger spherical and a distinguished lead backer. In the present day, the one-year-old firm is again with $20 million in Collection A funding, led by Tiger International, that places it at a $110 million post-money valuation. Fuse additionally participated within the spherical.

Garwood defined that going after new capital would give the corporate the runway to speed up towards its mission of being the “most well-liked distributor for each practitioner nationwide and produce transparency to the entire ecosystem.”

“They get to make use of digital components of the availability chain that they’ve by no means been requested to make use of earlier than,” he added. “Now is a crucial time as a result of the ecosystem is ripe for it. As well as, although funding markets have slowed, it’s clear that corporations with large visions and economies are getting funding and that’s what we’re all about.”

Garwood intends to make use of the brand new funding to proceed to construct and scale bttn’s worker numbers, specializing in enhancing the shopper expertise to take away the obstacles for them to buy quicker and simpler and reaching extra clients.

Bttn additionally continues to work on distribution capabilities amid a shopper conduct shift of wanting packages delivered shortly. Over the previous yr, the corporate has been in a position to cut back transport from between 12 to 21 days all the way down to between one to 5 days nationwide.

“After we approached this massive and antiquated market, we knew we might be doing extra to assist them and make an impression in so lots of the completely different layers of the availability chain,” Garwood stated. “Rising to succeed in them will probably be a problem, but when we step as much as the problem and scale in a method we consider we are able to, that’s what we’re going to must do.”

[ad_2]

Source link

Leave a Comment