[ad_1]

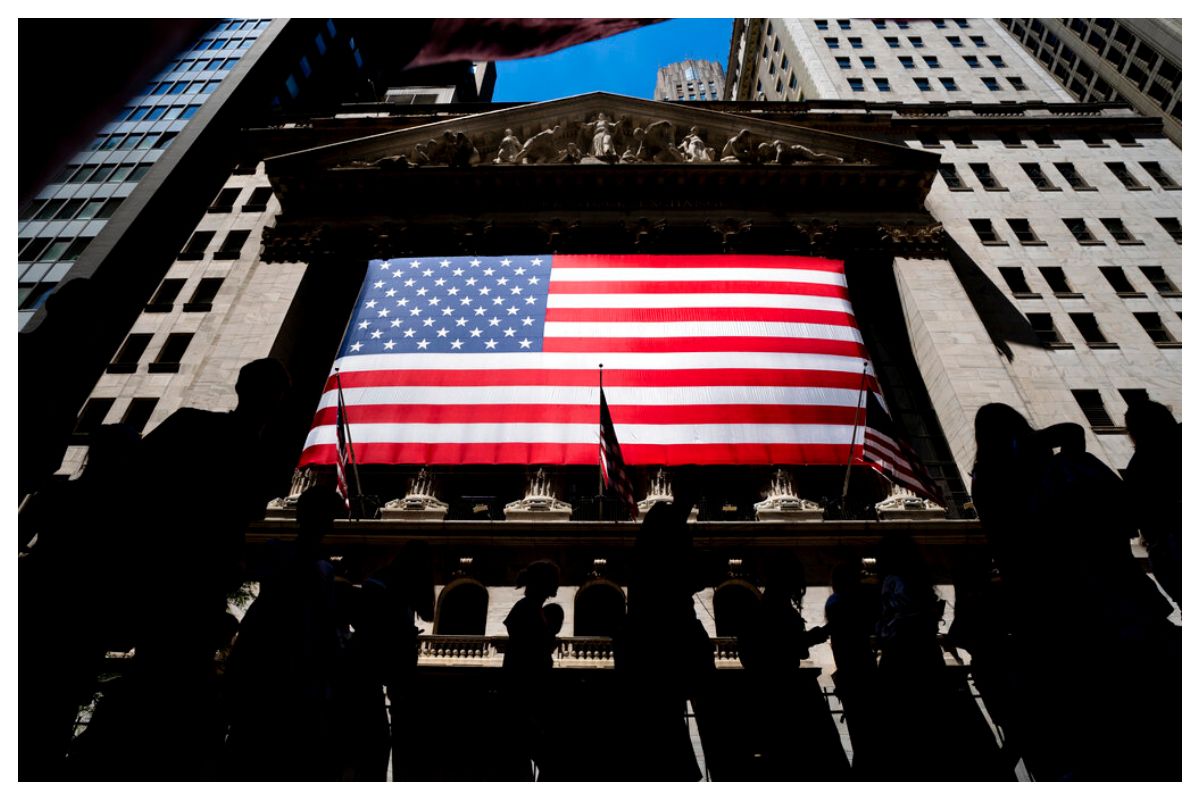

New York: Shares fell broadly in afternoon buying and selling on Wall Avenue Tuesday, extending a droop for the foremost indexes as buyers proceed to fret concerning the state of the financial system. The S&P 500 fell 1.5% as of 12:01 p.m. Jap. Greater than 85% of shares within the benchmark index fell within the weak opening following an extended weekend for the Independence Day vacation. The Dow Jones Industrial Common fell 562 factors, or 1.8%, to 30,532 and the Nasdaq fell 0.3%.Additionally Learn – 2 Police Officers Shot Throughout 4th of July Pageant In Philadelphia, Hours After Chicago Mass Taking pictures | VIDEOS INSIDE

Page Contents

Small-company shares additionally fell. The Russell 2000 shed 1.2%

Vitality firms had a few of the largest losses as U.S. oil costs fell 8.1%. Exxon Mobil shed 4%. Banks additionally fell considerably, together with bond yields. The yield on the 10-year Treasury, which helps set mortgage charges, fell to 2.79% from 2.90% late Friday. JPMorgan Chase fell 2.3%. Additionally Learn – US Independence Day 2022: How America Marks 246 Years of Freedom

European markets have been additionally decrease

Shares stay in a droop that pulled the S&P 500 right into a bear market final month, which means an prolonged decline of 20% or extra from a latest peak. The market’s efficiency within the first half of 2022 was the worst for the reason that first six months of 1970. Additionally Learn – seventh Pay Fee Newest Information: DA Hike For Central Authorities Workers Quickly? Test Particulars Right here

Inflation has been squeezing companies and shoppers all year long however tightened its grip after Russia invaded Ukraine in February. The invasion despatched oil costs larger globally and despatched gasoline costs within the U.S. to file highs. That prompted a pullback in spending from shoppers fighting larger costs on the whole lot from meals to clothes.

Lockdowns in China from rising COVID-19 circumstances have additionally made provide chain issues worse

Central banks have been elevating rates of interest in an try and mood inflation. The Federal Reserve has been aggressive in its shift from traditionally low rates of interest on the top of the pandemic to unusually large charge will increase. However, that has raised issues that the central financial institution may go too far in elevating charges and hitting the brakes too onerous on financial progress, which may carry on a recession.

Wall Avenue has been intently watching the newest financial updates for extra clues on how inflation is impacting the financial system and whether or not that would shift the Fed’s place on charge hikes. Wall Avenue will get a better have a look at the employment market on Friday when the federal government releases employment knowledge for June.

Traders are additionally looking forward to the following spherical of company earnings for a clearer image of inflation’s impression. A number of large firms not too long ago warned that their monetary outcomes are being squeezed by inflation, together with spice and seasonings maker McCormick.

[ad_2]

Source link

Leave a Comment